What’s New in income tax return online BD?

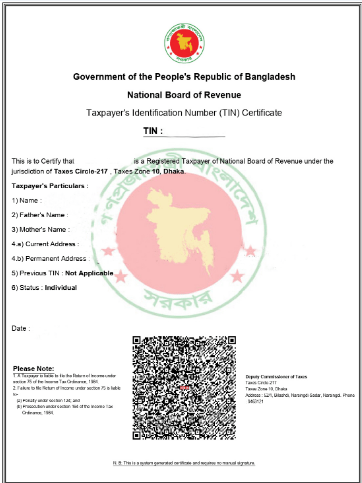

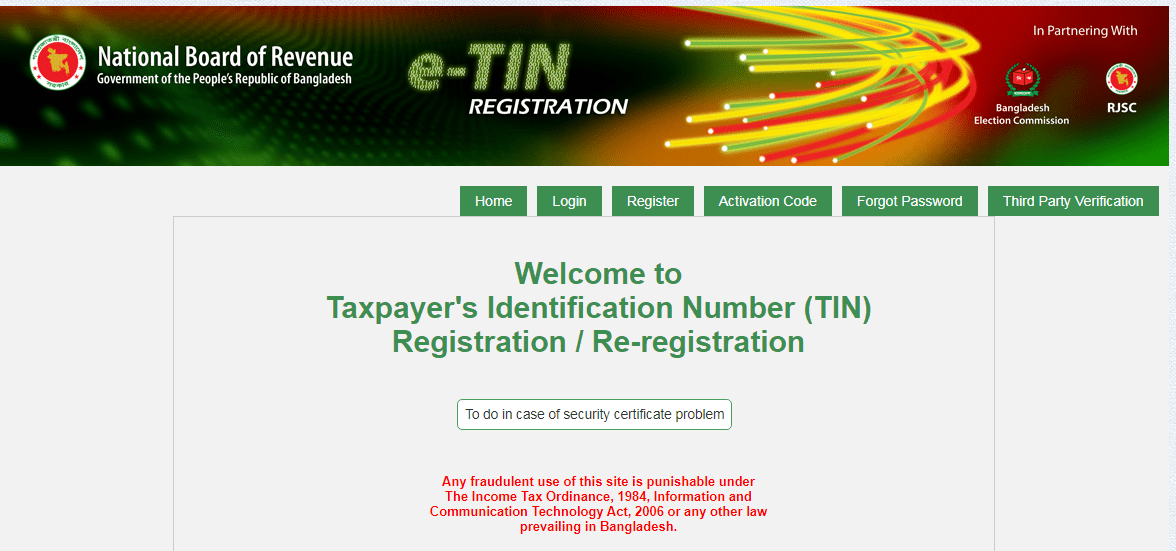

Efficiently Filing Your Income Tax Return Online: Tips and Tricks Introducing the latest update on income tax returns online BD.This comprehensive guide highlights the recent changes and enhancements to the online income tax return process in Bangladesh. Discover the convenience and efficiency of filing your taxes online, ensuring a seamless experience for taxpayers. Stay informed … Read more