With rapidly changing tax environment around the world today, better tax compliance and managing finances more efficiently has become necessary for individuals and enterprises. E-TIN Number (E-TIN) is one of the link in this process. It is basically a unique identification number that is made mandatory for everyone who will be engaged in taxable activities, and this 12 digit alpha numeric login is your digital access point to many tax-related services and benefits. This E-TIN simplifies the filing process and improves transparency through tax authorities. With a growing number of individuals and institutions shifting to online platforms, it is vital to comprehend its importance, so we can not only make sure that we are abiding by the rules but also take hold of available options in finance. This article discusses what E-TIN number is, How to get it and its significance in modern age of taxation.

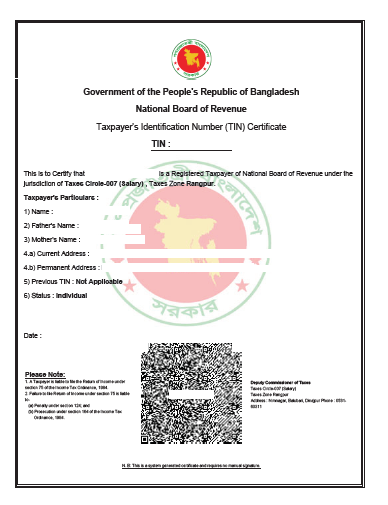

Given that much of our world is becoming digital, tax-related events are managed online for ease and record-keeping. A Tax Identification Number (TIN) is required for taxpayers including job holders and small business owners to file taxes electronically in Bangladesh. In this guide, we will help you to get your 12 digit e-TIN number online and describe all the parts of that process in detail.

The E-TIN number is not only a legal need but rather also an accommodation measure, which accelerates your taxation-related maneuvers and enables you to maintain proper record-keeping of all financial paperwork.

Related post: how to collect e tin certificate from online in BD [2024]

Step 1: Required Documents

To obtain an eTIN (Electronic Tax Identification Number) certificate in Bangladesh for the year 2024, a businessman may need to gather the following documents:

- Completed eTIN registration form/online form

- National Identification Card (NID) or Passport.

- permanent Address

- Trade License.

- Bank Solvency Certificate.

- Proof of business address.

- VAT Registration Certificate (if applicable).

- Latest Income Tax Return.

- Personal and Business Bank Statements.

For a job holder aiming to obtain an eTIN (Electronic Tax Identification Number) certificate in Bangladesh for the year 2024, the following documents might be needed:

- Completed eTIN registration form/online form

- National Identification Card (NID) or Passport.

- Permanent Address

- Proof of Employment (e.g., Employment Certificate or Contract).

- Latest Pay Slip.

- Proof of residential address.

- Latest Income Tax Return.

- Personal Bank Statements.

For a general individual looking to obtain an eTIN (Electronic Tax Identification Number) in Bangladesh for the year 2024, the required documents may include:

- Completed eTIN registration form/ Online Form

- National Identification Card (NID) or Passport.

- Permanent Address

- Proof of residential address. ( electric Bill copy) 5. Personal Bank Statements.

To obtain missing documents or prepare them correctly, consider visiting relevant local authorities or official branches that issue government identification. Make digital copies of physical documents for the online submission process.

Step 2: Visit the Tax Authority Website

To start the E-TIN registration process, head to the Bangladesh tax authority’s official website. You can reach it using the following URL: National Board of Revenue (NBR) E-TIN Registration](https://www.incometax.gov.bd).

- Open your preferred web browser.

- Enter the URL or search for ‘NBR E-TIN Registration’ on a search engine.

- Look for a section labeled as ‘e-Services’ or ‘e-Registration.’

At this juncture, ensure your internet connection is stable to avoid disconnection during the registration process.

Step 3: Access the E-TIN Registration Form

Upon locating the e-Registration section, you’ll find the E-TIN registration form. It’s vital that you carefully review all the fields and understand the information required:

- Click on ‘New Taxpayer Registration’.

- Choose between ‘Individual’ if you’re a job holder or ‘Business‘ for business owners.

- Begin to fill in the fields with accurate personal and/or business information.

- For the ‘Taxpayer’s Area’, select your tax zone based on your location or business location.

- Enter identification numbers from your National ID/Passport/Birth Certificate.

- Provide contact details, such as phone number and email address, as this information will be used for communication regarding your registration.

Tips for accurately filling out the form:

- Double-check each entry for accuracy.

- Fill out the form in a single sitting, if possible, to maintain focus.

- Refer back to your prepared documents to ensure the information matches perfectly.

Step 4: Submit the Application

Once all sections of the form are complete and reviewed, you can proceed to apply electronically:

- Click on the ‘Submit’ button at the bottom of the form.

- You may be prompted to verify the information via a confirmation screen or email verification.

Be aware of any additional submission requirements, like fees, which can vary based on the type of taxpayer and other factors. Pay any necessary fees according to the provided instructions.

Step 5: Tracking the Application

After submission, you’ll be given a reference number, which you can use to track the status of your E-TIN application. Here’s how:

- Keep the reference number handy for future inquiries.

- You can log back into the portal using your credentials to check the application status.

- Estimated processing times for E-TIN registration can vary, but usually, it takes a few days to a couple of weeks.

Patience is key while the authorities process your application.

Step 6: Receiving the E-TIN Number

Once your application is processed and approved, the E-TIN number will be communicated to you:

- Check your provided email regularly for official correspondence from the NBR providing your 12-digit E-TIN number.

- This E-TIN number will be your unique identifier for all tax-related matters in Bangladesh.

Once you have received your E-TIN number, ensure to keep it secure as it is sensitive information. You may now proceed to use this number for any required legal, financial, and business activities that require taxation documentation.

Conclusion

Obtaining your E-TIN number is a straightforward online process that brings you one step closer to hassle-free financial transactions and tax filings. By following these steps and ensuring you have all your documents in order, you can achieve this important milestone with ease. Remember, the E-TIN not only streamlines your tax filings but also strengthens the overall tax system’s effectiveness.

We encourage all eligible citizens, whether you are a small business owner, a taxpayer, or a job holder in Bangladesh, to take this important step towards financial organization and compliance. With these detailed instructions, you’re well on your way to obtaining your E-TIN effortlessly, empowering you to contribute to the nation’s growth and development.

Remember:

- Accuracy and preparation of documents are crucial in the E-TIN registration process.

- Regularly check the email provided during registration for notifications and your official E-TIN number.

- Keep your E-TIN number confidential and use it responsibly for all tax-related activities.

Read More:

How to Obtain an E-Trade License in BD: A Step-by-Step Guide!

Frequently Asked Questions about E-TIN

Q1: What is an E-TIN?

A1: An E-TIN, or Electronic Taxpayer Identification Number, is an online registration system for taxpayers in Bangladesh. This number is a unique identifier used for tax-related activities such as filing returns, making payments, and achieving financial compliance.

Q2: Who needs an E-TIN?

A2: Any citizen of Bangladesh who is a taxpayer requires an E-TIN. This includes individuals, job holders, and business owners.

Q3: What documents do I need to register for an E-TIN?

A3: Registering for an E-TIN requires several documents, such as a valid National ID Card/Passport/Birth Certificate, passport size photo, mobile phone number, email address, address information, and optionally bank account and business information for business owners.

Q4: How long does it take to get an E-TIN?

A4: The processing time for an E-TIN application can vary but it usually takes a few minutes to get online.

Q5: How do I track the status of my E-TIN application?

A5: After submission, you receive a reference number which you can use to track the status of your E-TIN application. You can log back into the portal using your credentials to check the application status.

Q6: How will I receive my E-TIN number?

A6: Once your application is processed and approved, the E-TIN number will be communicated to you through the email address you supplied during the registration process.

Q7: Is the E-TIN number permanent?

A7: Yes, once issued, the E-TIN number is permanent and does not change unless under special circumstances, such as legal name change or business restructuring.

Q8: Can I have more than one E-TIN?

A8: No, each taxpayer is only allowed one E-TIN. It is crucial to keep your E-TIN secure and confidential.

Q9: What should I do if I lose my E-TIN number?

A9: If you lose your E-TIN number, you should immediately contact the National Board of Revenue (NBR). You will likely need to provide identification and answer security questions to verify your identity.

Q10: What happens if I don’t register for an E-TIN?

A10: Failure to register for an E-TIN may result in penalties, including fines or legal action. All taxpayers in Bangladesh must register for an E-TIN.

You can check out this video for the detailed process-