An e-TIN certificate is an online tax ID. In Bangladesh, people pay tax based on yearly income. The government sets an income limit—if you earn more, you must pay tax.

The old TIN certificate is now digital. Every taxpayer needs an e-TIN certificate. You can get it online and pay taxes easily.

What is a Tax Identification Number (TIN)?

A Tax Identification Number (TIN) is a unique number for taxpayers. The online version is called an e-TIN. In Bangladesh, the National Board of Revenue (NBR) provides TINs. You can apply online or manually through the NBR website.

The government uses taxes to run the country. To make tax collection easier, the government introduced e-TINs. A TIN certificate is important for both people and businesses.

Tax Laws You Should Know

According to the Income Tax Ordinance of 1984:

- Using a fake TIN or someone else’s TIN can result in a BDT 20,000 fine.

- Not verifying a valid 12-digit TIN may lead to a BDT 50,000 penalty.

The Deputy Commissioner of Taxes (DCT) or other tax officials can impose these fines.

Why Do You Need an e-TIN Certificate?

An e-TIN certificate shows that you are paying tax properly. It prevents legal issues and ensures transparency.

You need an e-TIN for:

✅ Running a business

✅ Opening a bank account

✅ Buying savings certificates

✅ Joining a Deposit Pension Scheme (DPS)

✅ Buying a car

✅ Other financial transactions

Documents Needed for an e-TIN Certificate

To apply, you need:

📌 A passport-size photo (soft copy for online applications)

📌 Your National ID/Passport number

📌 Current & permanent address (with postcode)

📌 If applying for a business, you also need:

- Business name & TIN (for sole proprietors)

- Partners’ names & TINs (for partnerships)

- Sponsor Directors’ names & TINs (for companies)

- Incorporation/registration number & date (if applicable)

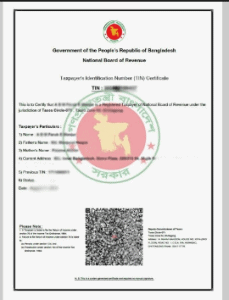

Understanding Your TIN Certificate

Your Tax Identification Number (TIN) certificate has important details:

- Your TIN number

- Your name

- Father’s and mother’s names (for individuals)

- Current and permanent addresses

- Business/employer name (if applicable)

- Registered office address (for companies)

- Previous TIN (if any)

- Status

How to Get an E-TIN Certificate

The National Board of Revenue (NBR) gives TIN certificates to track tax payments. You can apply online or manually.

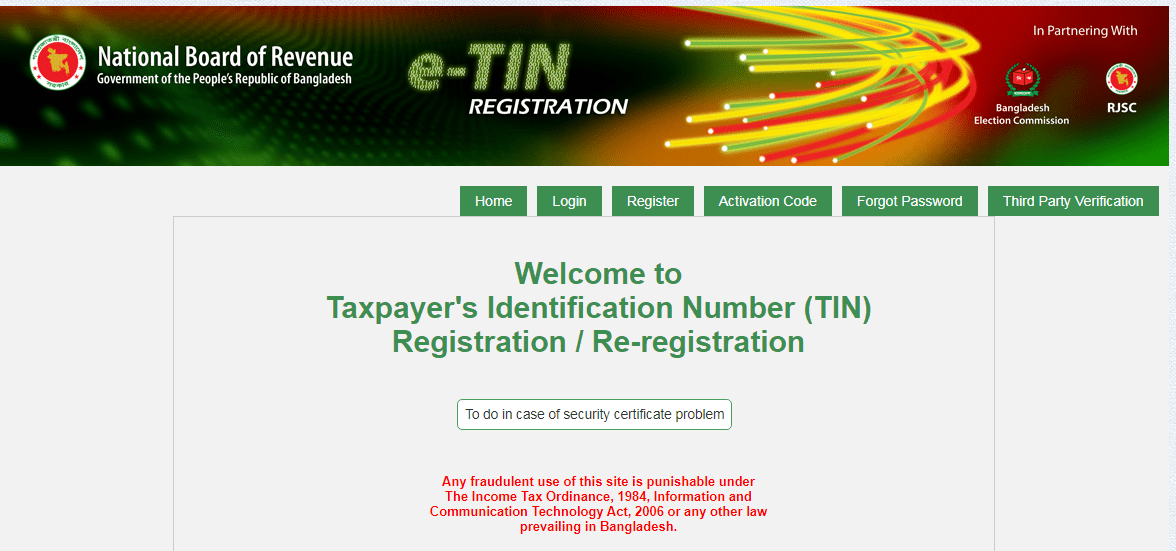

To get an E-TIN, register on the NBR website. No need to visit a tax office.

What You Need:

👉 For Individuals: 12-digit TIN, National ID, or Passport number.

👉 For Companies: 12-digit TIN and Incorporation number.

👉 Phone Number (auto-loaded, can be changed).

👉 Email Address (auto-loaded, can be changed).

Required Documents (Max 1 MB Total):

📌 Scanned copy of your TIN certificate.

📌 Scanned copy of your National ID, Passport, or Incorporation Certificate.

📌 Scanned online registration form.

📌 Recent passport-size photo (for individuals & companies).

Steps to Register for an E-TIN Certificate

✅ Step 1: Create an Account

🔹 Go to the NBR website and click “Register”.

🔹 Enter your User ID, Password, Security Question, Email, and Mobile Number.

🔹 Get a verification code via SMS.

✅ Step 2: Activate Your Account

🔹 Enter the code on the activation page.

🔹 Click “Activate”.

🔹 Click “New TIN Registration/Re-registration”.

✅ Step 3: Fill in Your Taxpayer Information

🔹 Choose Individual, Expatriate, or Company.

🔹 Select “New Registration” if you don’t have a TIN.

🔹 Enter your profession, income source, and location.

🔹 Provide your name, address, NID, and VAT Registration Number (if any).

✅ Step 4: Verify & Download Your Certificate

🔹 The system checks your details.

🔹 You can print or download your TIN certificate immediately.

Updating Your E-TIN Certificate in 2025

Keeping your E-TIN updated is important for:

✅ Opening a bank account

✅ Applying for loans

✅ Filing tax returns correctly

How to Update Your E-TIN:

1️⃣ Log in to the NBR website.

2️⃣ Click “Update E-TIN”.

3️⃣ Make necessary changes (name, address, business details).

4️⃣ Upload required documents (updated NID, trade license, or proof of address).

5️⃣ Review and submit your update request.

Keeping your E-TIN up to date is quick and easy. It helps you avoid legal issues and ensures smooth financial transactions.

Here’s a list of organizations in Bangladesh that assist with income tax filing and provide related services:

1. National Board of Revenue (NBR)

Website: [nbr.gov.bd]

NBR provides online resources, guidelines, and support to taxpayers for income tax filing.

2. Tax Zone Offices (Dhaka, Chittagong, etc.)

Local tax zone offices across the country offer in-person assistance with tax filing, consultation, and document submission.

3. ACNABIN Chartered Accountants

Website: [acnabin.com]

ACNABIN provides professional tax advisory services and assists businesses and individuals with income tax filing.

4. Hoda Vasi Chowdhury & Co.

Website: [hodavasi.com]

This accounting firm offers comprehensive tax advisory services, including income tax preparation and filing.

5. Rahman Rahman Huq (KPMG Bangladesh)

Website: [rrh.com.bd]

A KPMG member firm, Rahman Rahman Huq helps businesses and individuals with tax compliance, tax filing, and advisory.

6. A. Qasem & Co. (PwC Bangladesh)

Website: [pwc.com/bd]

As part of PwC, A. Qasem & Co. offers tax services including income tax return filing for businesses and individuals.

7. BD Tax

Website: [bdtax.com.bd]

An online platform that simplifies the process of filing income tax returns for individuals and businesses in Bangladesh.

8. FMC Consulting Ltd.

Website: [fmcgroup-bd.com]

This consulting firm offers tax advisory, tax planning, and income tax return filing services.

9. Moore Stephens Bangladesh

Website: [moore-global.com]

Moore Stephens provides professional tax services, including filing and compliance, catering to both individuals and corporations.

10. Grant Thornton Bangladesh

Website: [grantthornton.com.bd]

A global accounting firm offering tax filing, advisory services, and financial planning for individuals and businesses in Bangladesh.

These organizations provide a range of services from tax consultation to complete filing assistance for both personal and corporate income taxes. you can get help from the above firm for income tax filing both for personal and company in 2025.

How to Submit an Income Tax Return Online in Bangladesh

Why File a Zero Return?

Filing a zero return helps you follow tax rules. If you don’t file, you might face fines, lose your TIN, or have trouble getting government services like trade licenses, loans, or car registrations. Keeping your tax records updated is also important.

Steps to File an Income Tax Return Online

1. Log in to the NBR Portal

Go to etaxnbr.gov.bd. If you don’t have an account, sign up with your TIN and personal details.

2. Open the Return Filing Section

After logging in, go to ‘Income Tax Return.’ Choose the tax year (e.g., 2024-25).

3. Choose the Zero Return Option

In the income section, select ‘Zero Return.’ This means you had no taxable income.

4. Enter Your Information

Fill in your name and address. You don’t need to enter income details.

5. Submit the Form

At the end, confirm that your income is zero and submit.

6. Get Your Acknowledgment Slip

After submission, you’ll get a slip. Save it as proof that you filed your return.

Submitting a zero return tax in 2025 is a simple process but is vital for compliance with Bangladeshi tax laws. Make sure to file on time and keep a record of your submission for future reference.

In conclusion, If you’re looking for an easy way to collect your e-tin certificate online in Bangladesh, you’ll want to check out the following video! It outlines the step-by-step process of collecting your e-tin certificate online in BD. From there, all you have to do is follow the instructions carefully to ensure a smooth and successful collection process.

let’s start to watch the video and collect your e-tin number easily only in 5 minutes. Thanks for reading!